Embark on a journey into the realm of Great Plains Accounting, unraveling its complexities and significance in the business landscape.

Delve into the evolution and impact of this powerful accounting software as we uncover its core functions and features.

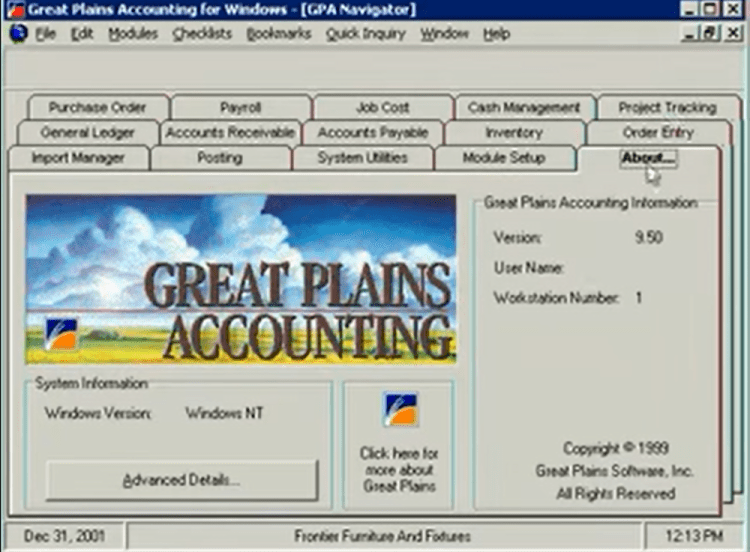

Overview of Great Plains Accounting

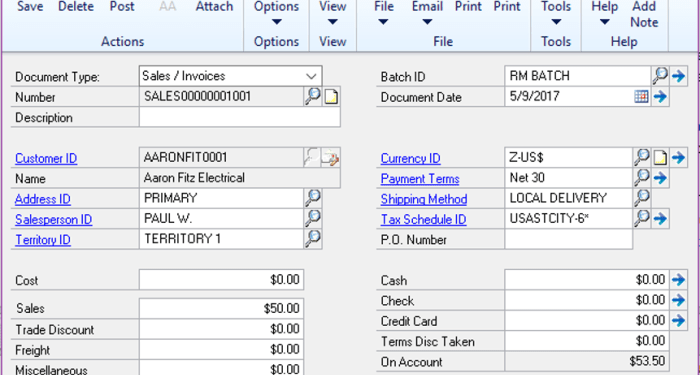

Great Plains Accounting is a comprehensive financial management software designed to help businesses manage their accounting, finance, and operations efficiently. It provides tools for budgeting, financial reporting, payroll processing, inventory management, and more.

Brief History of Great Plains Accounting

Originally founded in 1981 by Doug Burgum, Great Plains Software developed the Great Plains Accounting software to cater to the accounting needs of small to medium-sized businesses. In 2001, Microsoft acquired Great Plains Software, rebranding the software as Microsoft Dynamics GP.

Importance of Great Plains Accounting in the Business World

Great Plains Accounting plays a crucial role in streamlining financial processes, improving decision-making, and ensuring compliance with accounting standards. It helps businesses maintain accurate financial records, analyze performance metrics, and make informed strategic decisions to drive growth and profitability.

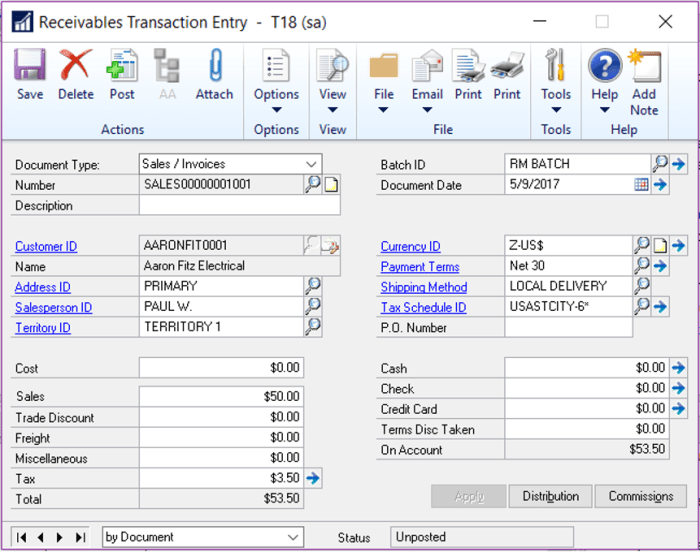

Features of Great Plains Accounting

Great Plains Accounting offers a variety of features that cater to the needs of businesses of all sizes. Let's explore some key features and how they benefit businesses.

Multi-currency Management

Great Plains Accounting allows businesses to manage transactions in multiple currencies efficiently. This feature is essential for companies engaged in international trade or with foreign clients.

Customizable Reporting

The software provides customizable reporting options, allowing businesses to generate detailed financial reports tailored to their specific requirements. This feature enables better decision-making based on accurate and relevant data.

Inventory Management

Great Plains Accounting offers robust inventory management capabilities, helping businesses track their stock levels, manage reordering, and optimize inventory turnover. This feature ensures that businesses have the right products available at the right time.

Integration with Other Systems

Great Plains Accounting can be seamlessly integrated with other systems such as CRM software, e-commerce platforms, and payroll systems. This integration streamlines business processes and eliminates the need for manual data entry, saving time and reducing errors.

Scalability

Whether a small startup or a large enterprise, Great Plains Accounting is scalable to accommodate the growth of businesses. This flexibility ensures that the software can grow with the company's needs, without the need for a complete overhaul of the accounting system.

Implementation of Great Plains Accounting

Implementing Great Plains Accounting involves several key steps to ensure a successful integration of the software into your organization's financial processes. Below, we will discuss the steps involved, share best practices for a successful implementation, and address common challenges faced during the process.

Steps Involved in Implementing Great Plains Accounting

- Define Objectives: Clearly Artikel the goals and objectives you aim to achieve with the implementation of Great Plains Accounting.

- Planning: Develop a detailed implementation plan that includes timelines, resource allocation, and key milestones.

- Data Migration: Transfer existing financial data into the Great Plains system to ensure continuity and accuracy.

- Training: Provide comprehensive training to staff members who will be using the software to maximize its efficiency.

- Testing: Conduct thorough testing to identify and resolve any issues before fully integrating Great Plains Accounting into your financial processes.

- Go-Live: Roll out the software across the organization and monitor its performance to address any immediate issues.

Best Practices for a Successful Implementation

- Engage Stakeholders: Involve key stakeholders throughout the implementation process to ensure their buy-in and support.

- Customization: Tailor Great Plains Accounting to meet the specific needs of your organization for optimal performance.

- Continuous Support: Provide ongoing support and training to users to enhance their proficiency with the software.

- Regular Evaluation: Continuously evaluate the performance of Great Plains Accounting to identify areas for improvement.

Common Challenges Faced During the Implementation Process

- Resistance to Change: Some staff members may resist adopting new software, requiring change management strategies to overcome this challenge.

- Data Integrity Issues: Data migration can sometimes lead to integrity issues, necessitating thorough validation and quality checks.

- Lack of Training: Insufficient training can hinder user adoption and lead to underutilization of Great Plains Accounting.

- Integration Problems: Compatibility issues with existing systems or processes may arise, requiring technical expertise for seamless integration.

Integration with Other Systems

Great Plains Accounting offers seamless integration with various other business systems, allowing for a more streamlined and efficient workflow.

Benefits of Integrating Great Plains Accounting

- Improved data accuracy and consistency across different platforms.

- Enhanced productivity through automated data transfer and synchronization.

- Greater visibility into financial information and reporting.

- Reduced manual data entry and risk of errors.

Popular Integrations with Great Plains Accounting

Great Plains Accounting can be integrated with a wide range of software to further enhance its capabilities. Some popular integrations include:

- Microsoft Office Suite - for seamless data exchange and reporting.

- CRM systems like Salesforce or HubSpot - for improved customer relationship management.

- E-commerce platforms like Shopify or WooCommerce - for simplified order processing and inventory management.

- Payroll software like ADP or Paychex - for streamlined payroll processing and compliance.

Security and Compliance in Great Plains Accounting

When it comes to handling sensitive financial data, security and compliance are paramount in any accounting software. Great Plains Accounting prioritizes these aspects to ensure the protection of data and adherence to industry regulations.

Security Measures in Great Plains Accounting

Great Plains Accounting employs robust security measures to safeguard your financial information. This includes user authentication protocols, data encryption, role-based access control, and regular security updates to address any vulnerabilities.

Compliance with Industry Regulations

Great Plains Accounting is designed to meet industry regulations such as GAAP (Generally Accepted Accounting Principles) and SOX (Sarbanes-Oxley Act). By following these standards, the software helps businesses maintain compliance and integrity in their financial reporting.

Tips for Maintaining Data Security and Compliance

- Regularly update your software: Ensure that you are using the latest version of Great Plains Accounting to benefit from the latest security patches and enhancements.

- Restrict user access: Implement role-based access control to ensure that users only have access to the data and functions necessary for their roles.

- Backup your data: Regularly back up your financial data to prevent loss in case of system failures or security breaches.

- Train your staff: Provide training on data security best practices to employees who have access to Great Plains Accounting to prevent accidental data exposure.

Last Point

In conclusion, Great Plains Accounting stands as a pivotal tool for businesses, ensuring efficiency, compliance, and security in financial operations. Dive into this dynamic world and revolutionize your accounting practices today.

Questions and Answers

What are the primary functions of Great Plains Accounting?

Great Plains Accounting is designed to manage financial tasks such as accounts payable, accounts receivable, general ledger, and financial reporting.

How does Great Plains Accounting ensure compliance with industry regulations?

Great Plains Accounting implements robust security measures and follows industry standards to ensure data security and compliance with regulations.

Can Great Plains Accounting integrate with other business systems?

Yes, Great Plains Accounting can integrate with various business systems to streamline processes and enhance efficiency.